)

(Your Loan Hub)

Smart tips for paying off your home loan sooner

We look at some things you could do.

Australian home loan interest rates remain at historic lows, and the opportunities for paying off a mortgage early are better than ever. Used in conjunction with low rates, here are some extra steps that can speed up loan repayments and reduce your loan balance.

Make higher repayments

One of the easiest ways to quickly reduce the balance of your mortgage is to make larger loan repayments. The minimum repayments required on a loan are calculated on the amount owing and the prevailing home loan interest rate. Repaying more than the minimum can cut the overall term of the loan and save you thousands of dollars in interest. A mortgage repayments calculator will quickly show what savings can be achieved.

Some lenders may charge you an early payment cost for paying your loan in advance. This is particularly the case with fixed-interest loans, so it's always best to check up-front. These costs can be large.

Make more frequent repayments

Home loans are often structured so that you make monthly repayments. But making fortnightly repayments instead can reduce the term of a loan and save interest. By making fortnightly repayments, you are paying the equivalent of half of your monthly repayment every two weeks. This allows you to make the equivalent of one extra monthly repayment per year. Extra repayments will ensure the loan balance is lower at the time of the month the interest is calculated.

Use an interest offset account

Most lenders allow you to package a mortgage with an interest offset account. An offset account allows you to reduce the amount of interest paid on your loan by offsetting the amount in the (offset) account against your loan balance. Wages and other income can be deposited into your offset account. Note that you don't earn interest on the funds in the offset account, and that offset is usually only available on variable rate loans.

Although obvious, many borrowers take out a mortgage and then stop following the home loan market. With interest rates constantly changing, it pays to monitor the latest rates. If rates go down, contact your lender or broker and ask if they can reduce the rate on your loan.

Don't take the rate cut

When a lender reduces the interest rate on its home loans, usually in line with a cut in official interest rates, your first thought may be to reduce your loan repayments accordingly. However, by maintaining your loan repayments, you effectively repay more than the minimum loan repayment. If it's possible to do so, this will help you cut the term of the loan and save on interest.

Pay both principal and interest

While you can make lower repayments by choosing an interest-only loan, doing so means the principal component of the loan will not be repaid while you are only paying interest.

Pay fees upfront

When initially taking out a mortgage, lenders will often roll the establishment costs and charges into the loan. While this may help the short-term budget, it's worth paying these costs separately to lower the overall balance of the loan from the start.

Use your home equity

As home prices rise, you build more equity in your property. Redrawing funds from a home loan to pay for renovations and other costs can be a much cheaper source of funds than others.

Set up a split loan

A split loan, sometimes referred to as a combination loan, enables borrowers to divide their mortgage into both variable and fixed components. By doing this, you can not only make extra payments on the variable component, but also lock in a lower fixed rate. Extra payments can often be made on the fixed loan too, up to a limit specified by the lender.

Get a financial package

You can often lock in a discounted loan rate with a financial package and also find special rates on other products and services. Putting those savings into your mortgage is a great way to get the best of both worlds.

With just a few easy steps, borrowers can significantly reduce the length of their mortgage and save thousands of dollars in the process. A mortgage broker can assist you in setting everything up.

For more information on how you can pay off your home loan sooner, contact your mortgage broker.

| Posted in:News |

)

Money and Life

(Financial Planning Association of Australia)

With tap and go payments becoming ever more popular and the advent of instant transfers between domestic bank accounts, how much longer will we be using cash as a form of payment? Find out more about when we can expect Australia to go completely cashless and what it means for us, as business owners and consumers.

Got any cash on you?

According to recent survey results produced by You Gov Galaxy and commissioned by payments provider Square, the average answer to this questions is likely to be 'about $38' if you're under the age of 40. Baby boomers are much more likely to have a few more notes and coins on them, carrying $72 in cash on average. And almost five million Aussies haven't visited an ATM within the last 4 weeks or can't even recall the last time they withdrew cash[1].

Put this together with the Reserve Bank of Australia's report from 2016 that found only 37% of payments in Australia were being made in cash and you can see where we're heading a time when having cash just won't be necessary or practical for the vast majority of the transactions we make. Using the RBA's data from 2016, comparison site Finder have forecast that cash could disappear completely from Australia as soon as 2026[2]. But do we have good reason to look forward to being a cashless economy and society?

Tap happy?

Unfortunately, the convenience of tap and go payments may end up having a negative impact on our ability to keep our spending within reasonable limits. According to a study from the University of Sydney, people can be expected to spend up to 50% more by paying with any payment type other than cash. "There's good empirical evidence that people spend more money when they don't actually have to use cash, and that goes across different alternative forms of payment," says Donnel Briley, Professor of Marketing and Behavioural Psychology at the University of Sydney.

A survey of high school students back in 2017 demonstrated that many teens simply don't understand key concepts around personal borrowing with credit cards. This makes them particularly vulnerable to the perils of buying something without really thinking through how much it costs in real terms. When there is interest to pay on their purchase, as well as the opportunity cost of having already spent the money, young people can be particularly vulnerable, to buyer regret as well as serious financial struggles when they're saddled with repayments on long-term debts.

For parents of kids, teens and young adults help is at hand. In 2018, the FPA commissioned research into our 'invisible money' generation and how parents are handling the challenges of raising kids to be financially savvy in an increasingly cashless context. The How to talk money with children e-book is packed with insights, advice and tips from experts on sharing good money habits with children in the digital age.

Good and bad for business

As well as presenting economic challenges for consumers, a cashless world also has pros and cons for businesses. While some small and medium sized businesses might celebrate saying goodbye to hours spent counting notes and coins 216 hours on average each year according to the You Gov Galaxy/Square survey others could be losing out on revenue with less cash changing hands. A 2017 survey by ME Bank reports a 51% fall in cash payments in the last five years for industry employees traditionally remunerated in cash, such as tradespeople and hospitality staff. Tipping and on-the-spot charity donations are two of the biggest casualties of the disappearance of cash, with each recording falls of 45% and 44% respectively in the frequency of cash payments in the same period.

Easier than EFT

A significant game changer for Australia's move towards being cash-free could well be the National Payments Platform (NPP). Officially launched in February 2018, the NPP technology could end up replacing many EFT and cash transactions but hasn't been offered broadly by financial services institutions yet. Assuming that widespread adoption of the NPP, and its associated services like PayID and Osko, are just a matter of time, the move towards a cash-free economy could pick up speed in the months and years to come. Watch this space.

Want to get ready for a brave new cash-free world? Read our insider's guide to invisible money to get up to speed on all the latest apps and advice.

[1] The Australian, One-in-three shoppers go cashless: poll, Luke Costin, 17 September 2018 https://www.theaustralian.com.au/news/latest-news/oneinthree-shoppers-go-cashless-poll/news-story/f3ed60f050d15e5f1609da7a2497ba08

[2] News.com.au, Cash payments predicted to disappear within a decade as tap and go takes over, Alexis Carey, 24 May 2018, "A projection of that data by comparison site finder.com.au has revealed that if the current trend continues, physical cash could vanish in Australia as soon as 2026." https://www.news.com.au/finance/business/retail/cash-payments-predicted-to-disappear-within-a-decade-as-tap-and-go-takes-over/news-story/75026efec69b7e4bbdee90b1dd363429

| Posted in:News |

)

Money and Life

(Financial Planning Association of Australia)

Are your family finances a battleground where good and bad habits collide? Find out how to support your family towards better financial wellbeing without risking your relationship.

Sometimes money can really drive a wedge between family members. When you have a parent, sibling, child or maybe even a partner who seems determined to sabotage their finances, it can be difficult to know how to help or where to draw the line with handing over cash.

Here are five important things to think about when it comes to handling family finances so you can keep your relationships and finances healthy and stable.

1. Where does it come from?

Talking to someone in your family about why they're bad with money can be a confronting experience for both of you. But if you can tackle it without blame or judgement, it can build a more equal and understanding relationship between you. Showing genuine interest in why someone struggles with financial hardship can go a long way towards resolving the tension and conflict that often comes with talking about money.

When gambling or addiction are involved, getting professional help can allow them to deal with financial troubles as part of a larger problem they need to overcome. If holding down a job is the challenge, you can support them towards better career choices by talking to them about their strengths, looking at training options and helping with their resume. Whatever the root of the problem, getting it out in the open can help you understand the best way of offering or finding the support they need.

2. Gifts and handouts

Sometimes you'll want to act on your goodwill towards family with a cash gift or loan of some kind. In the right circumstances, giving someone a handout can be just what they need to get them out of a negative spiral or just take the pressure off so they can make a plan and a budget they can stick to. And if you want to help them financially but keep control of how the money is spent, you could offer to pre-pay bills.

If it's a cash handout, make sure you both understand whether you're making it a gift or a loan. If it's to be a loan, make a written agreement for a realistic repayment schedule you're both comfortable with. While it might be a tricky subject to bring up, talk about what will happen if they don't pay you back. Even if you've helped in the past, it doesn't mean you have an unlimited budget for gifting or lending money to family. So whatever type of financial help you're offering, you should be confident you can afford it, whether they pay you back or not.

3. When to say no

Saying no to a request for money can be tricky. You might be worried that refusing to provide a gift or loan will make your relationship come unstuck and create problems for a person you care about. But think of the strain you'll put on yourself and your relationship if you offer money you simply can't afford to give. Helping in other ways can be a good way to let a family member know you care and want the best for them. Lending tools, appliances or a vehicle can save them on the cost of buying them. Helping with childcare or housework may be just what they need to make more time for earning money. So there are lots of ways to help without actually digging into your own pocket.

4. Budgeting and other good money habits

If you've got good money-management skills, take the time to share them. Being a budget mentor is one of the best and easiest ways to help a family member who is struggling to make ends meet. Sit down with all their bank and credit card statements, bills and payslips and take a good look at how much money is coming in and where it's going. Talk about what they value and how to prioritise that in their spending and save on other things. And introduce them to some budgeting apps to make it easier for them to track their spending, if you think that's going to suit them.

Sometimes people need a little nudge to hunt down a bargain rather than take the first price they're offered. Just by introducing your family member to comparison tools for things like energy bills and insurance you can begin an important change in their approach to spending.

5. Call in the experts

You might be a budgeting maestro, but sometimes it takes an expert to get family finances on track. There are all sorts of ways that financial advice can make a difference to you and your family finances. They can help you determine if a gift or loan is affordable in the context of your other financial goals, like saving for retirement or getting debt free. And having someone step in and provide your family member with impartial advice when they're in a financial mess can be just what you all need to make sure they're getting support without putting pressure on your relationship and your own finances.

Whatever your family or financial situation may be, a CERTIFIED FINANCIAL PLANNER® professional can offer valuable advice on budgeting, dealing with debt and planning for a better financial future.

| Posted in:News |

)

Money and Life

(Financial Planning Association of Australia)

It's all very well having retirement savings as a financial goal, but just how much should you plan to have in your super balance now, and when you retire? Find out more about coming up with a super balance target, for your age group, and for the retirement lifestyle you have in mind.

Above or below average?

Assuming you've been in the workforce for a few months, years or even decades, your retirement savings will be growing nicely thanks to the Super Guarantee. This is the compulsory contribution to super your employer must pay on your behalf. You can keep tabs on just how much you have by checking your latest super statement, logging on to your MyGov account, or your super fund's online portal.

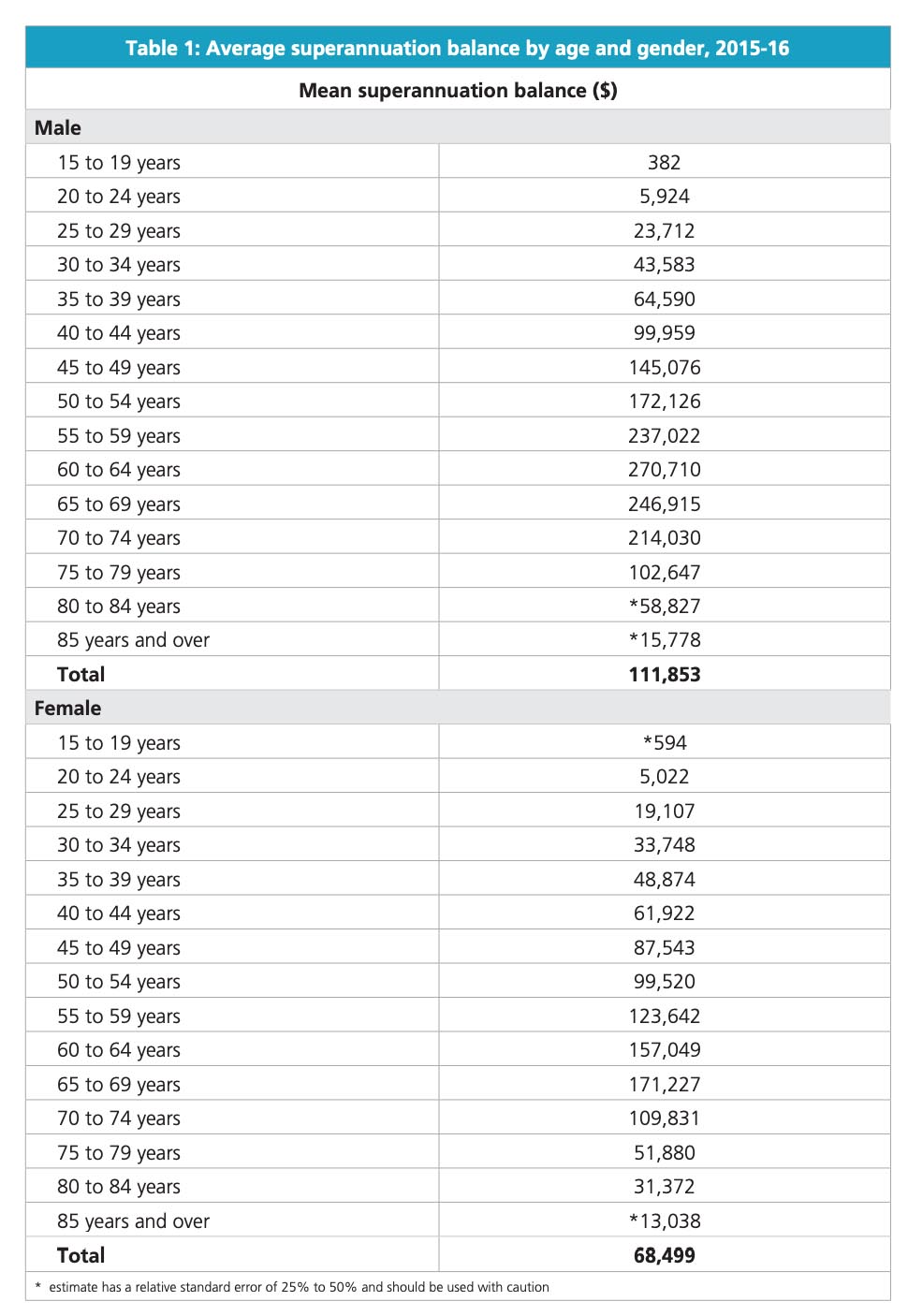

Once you've checked up on your super savings, how can you tell if it's enough to see you living comfortably in retirement, whether that's in 5 or 25 years' time? To get an idea of how your super savings compare with others your age, the Association of Superannuation Funds of Australia (ASFA) has published average super balances held by different age groups, including figures for men and women. So if you're currently aged 40-44, your peers have an average balance of just over $80,000. That average rises to a peak of almost $215,000 in the years approaching retirement (60-64).

How much is enough?

Putting a figure on how much you'll need saved to cover your costs in retirement is a tricky task. There are so many unknowns for each of us, including when we're going to retire, how long we'll live once we do and what we'll be spending our time doing. This is why many people seek advice from a Certified Financial Planner® professional to get financially ready for retirement. They can ask the right questions and help you run the numbers to give you a clear picture of your retirement goals and plan for the income you'll need to achieve them.

To get a more general idea of what you can expect to spend in retirement, the ASFA publish retirement standard figures each quarter. As a well-researched estimate of what singles and couples will need to pay their bills for a modest or comfortable retirement lifestyle, these figures offer a rough idea of living costs. The Milliman Retirement Expectations and Spending Profiles (ESP) report is also published quarterly. Based on data gathered from 300,000+ Australian retirees, their reports put spending in retirement under the microscope to help people plan better for their financial needs in retirement. According to data and commentary from their February 2018 ESP report for example, Milliman found that over half of Australian retirees are actually living on less than the Age Pension each year.

Having said this, results from the 2017 FPA Live the Dream survey show that just 22% of baby boomers say they're living the dream in retirement. And the number one obstacle standing in their way is a low bank balance (39%). So while a modest income may be enough to live on, perhaps a bigger nest egg is important for making retirement dreams come true.

Should I save more?

As well as these different estimates about how much you'll need in retirement, here are some important ideas to bear in mind if you're uncertain about the importance of topping up your super with extra contributions:

Looking for a way to budget for extra super contributions? Salary sacrificing into super can be a great way to cut your tax bill and boost your super contributions at the same time.

References

[1] ASFA, Superannuation account balances by age and gender, October 2017, page 9, Table 1: Average superannuation balance by age and gender, 2015-16 https://www.superannuation.asn.au/ArticleDocuments/359/1710_Superannuation_account_balances_by_age_and_gender.pdf.aspx?Embed=Y

[2] PWC, Understanding the unpaid economy, March 2017, page 1, 'Women are significantly over-represented in the unpaid economy, accounting for almost three quarters of all unpaid work.'

https://www.pwc.com.au/australia-in-transition/publications/understanding-the-unpaid-economy-mar17.pdf

| Posted in:News |

)

Money and Life

(Financial Planning Association of Australia)

If you've got retirement in your sights this year, we've got the ultimate checklist to help you retire in style. Discover how to prepare for this exciting new chapter in your life, safe in the knowledge that your finances will be taking care of you.

1. Explore your goals and make plans

Enjoying retirement to the full isn't just a matter of money. It's just as important to have a good long think about what you'd like to be doing when you're no longer going to work. Will you want to travel or spend time with family or keeping fit? And when you're faced with the idea of stopping work completely, you may want to continue working part-time or volunteer. A gradual transition to retirement can be a good way to manage your income needs too.

2. Work on your budget

When you do stop earning a salary your nest egg is going to have to last you for the rest of your life. So you'll need to think carefully about what you have to draw on assets, savings, investments and government benefits and what you'll be spending money on, including day-to-day expenses and household bills, your rent or mortgage and insurance as well as funding other retirement plans like trips overseas.

3. Reduce your debts

Interest on your mortgage, loans and credit card balances is a cost you'd rather not be paying once you're relying on retirement savings for your income. If you have the funds to do so, it may make sense to settle as many of your debts as possible before you start planning and budgeting for retirement.

4. Budget for big ticket items

Don't forget to include the cost of replacing your car, appliances or making major repairs to your home in your budget. The things you own and rely on will be ageing along with you and planning for these big bills will stop them having an impact on your day-to-day cash flow.

5. Check your eligibility for government benefits and super

Government benefits like the age pension and seniors card can make a significant difference to your income and budget but are you entitled? Depending on your circumstances, the process for being assessed and applying for these benefits can be complex so it's a good idea to investigate this before you actually retire. There are also rules around accessing your super savings, including how old you need to be. Make sure you're not counting on income from super if you're still too young to draw on it.

6. Find out about tax

There are tax benefits and concessions available to retirees receiving income from their super, but these depend a lot on how you invest your money. And government policies and legislation around super investments and income and how they are taxed has changed a lot recently. So when it comes to choosing tax-effective investments that offer opportunities to earn a stable income, professional advice from a financial planner can help you make the right decisions.

7. Make a retirement income timeline

Working with a planner can also help with managing your cash flow during retirement. If you're drawing income from a number of different "pots" like super, any savings or investments you may have outside of super or the age pension you'll probably find it helpful to forecast how much you're going to need from each one over time. If you're planning to downsize to release equity from your home for example, an income timeline can influence when you decide to sell.

8. Take care of family matters

Is providing for your children likely to be a priority for you either before or after your death? If you're planning to transfer some of your wealth to family through a will, make sure this is accounted for in your retirement budget and financial plan. And if you're expecting to help your children with financial and lifestyle goals in the near future such as buying a house or getting married bear in mind your own financial wellbeing and security before making the commitment. You may also want to consider making arrangements for one or more family members to act as your power of attorney in case you lose capacity for making financial decisions.

9. Find the right financial planner for you

A financial planner can help you get the right approach to managing your money for a secure and stable income that's going to last throughout your retirement. For example, they can offer valuable advice on whether clearing debts is going to stop you from having a savings and investment balance that can deliver enough income to meet your needs. They can also help you draw up a realistic budget that takes into account all your retirement goals, including transferring wealth to your children if that's important to you.

Your planner is likely to provide you with guidance and advice throughout your retirement years. So it's important to find a planner you feel comfortable with and who has the expertise and understanding of your unique needs that can deliver the best advice and results.

10. Plan to be in the best of health

All the money in the world won't help you enjoy retirement if you're not in good health. Whether it's including a gym membership, a new bike, home gym or stand-up paddle board in your budget, having a way to keep fit will go a long way towards maintaining your health and mobility as you age. And don't forget to review your health insurance, both before you retire and as you age, to make sure you can continue to meet the cost of managing your health.

Want to find out how advice from a CERTIFIED FINANCIAL PLANNER®professional can help you get ready for retirement this year? Read our financial planner's guide to preparing for retirement.

| Posted in:News |